Every Exchange Vacation in the RCI system is assigned a Trading Power value. This value, known as Exchange Trading Power (ETP), is then compared to your Deposit Trading Power (DTP) to determine which vacation are available to you.

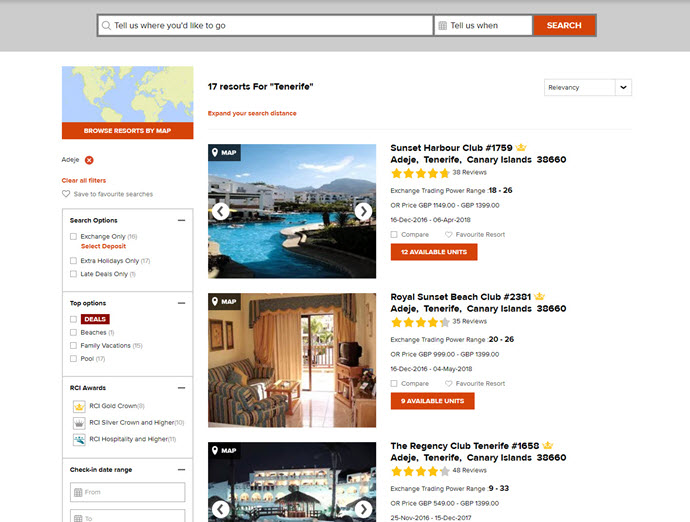

Similar to Deposit Trading Power, Exchange Trading Power is mainly influenced by supply, demand and utilisation at the time of your vacation search. For example, if you’re searching for an Exchange Vacation in Colorado during the ski season, the Exchange Trading Power required is generally going to be higher than if you were to search for the same destination in May or June. When searching for available Exchange Vacation options, you’ll see the Exchange Trading Power for each resort property listed on the right hand side.

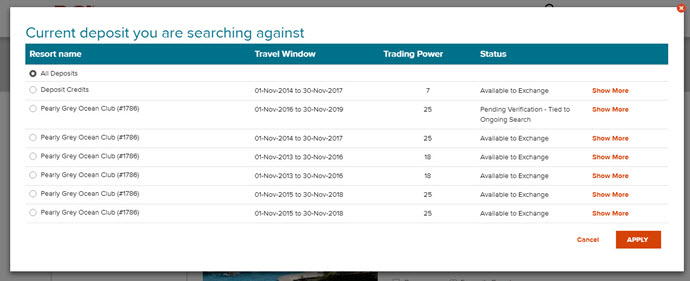

When looking for an Exchange Vacation you can choose to search for all exchanges available in the system or just those exchanges that are equal to, or less than, the trading power of your Deposit.

How is Exchange Trading Power different from Deposit Trading Power?

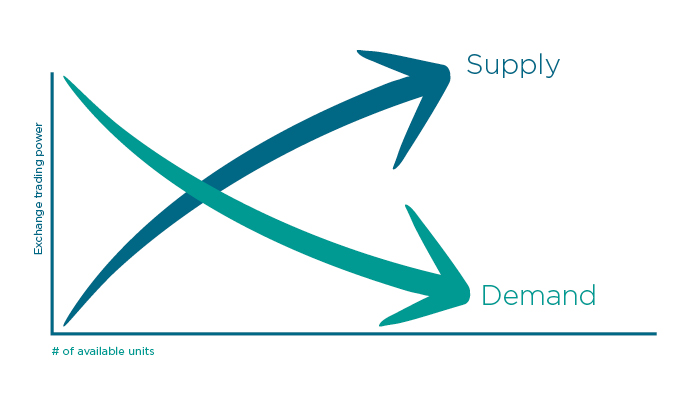

The main difference between Deposit Trading Power and Exchange Trading Power is that Deposit Trading Power at time of depositing the Trading Power is fixed. Exchange Trading Power is always changing, as the supply and demand of vacation can fluctuate throughout the life of the available Exchange Vacation.

• Exchange Trading Power will go up (i.e. The ETP value may go up for example from 20 to 24 over a period of time) if demand exceeds supply. This is more likely to happen in highly demanded destinations during highly demanded periods throughout the year.

• Exchange Trading Power will go down (i.e. The ETP value may go from 12 to 7 over a period of time) if supply exceeds demand. This is can happen in low demanded area low demanded periods throughout the year.